Law enforcement characterizes white-collar crime as a nonviolent crime whose primary motive is personal financial gain. White-collar criminals are usually corporate insiders who occupy positions of trust.

This article covers the basic features of white-collar crime, its essential elements, its defenses, some of its past offenders, and the common misconceptions about it.

The Nature Of White-Collar Crime

White-collar crime is a term that is usually applied to crimes associated with a business that do not involve violence or bodily injury to another person.

Examples of white-collar crimes are those generally associated with lending institutions involving bank fraud, such as making false statements to obtain a loan, filing false reports or tax returns with government agencies, embezzlement, using mail or wire communications to defraud, and paying or accepting bribes.

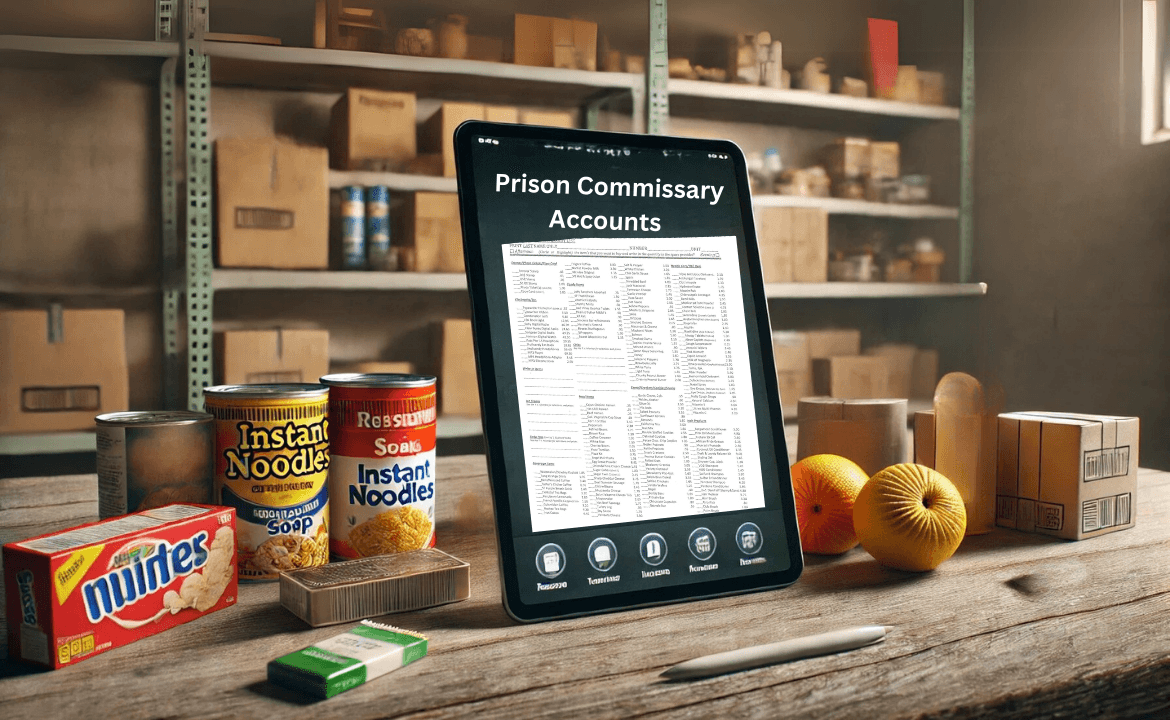

White-collar crimes may be prosecuted in state or federal courts, depending upon whether state or federal laws have been violated. The penalties for committing white-collar crimes vary, but in some cases, they may be as severe as those prescribed for violent crimes.

Types of White Collar Crimes

Falsifying Business Records

Definition: Making false entries or altering business documents intending to defraud.

Example: Dennis Kozlowski, former CEO of Tyco International, was convicted of falsifying business records to conceal unauthorized bonuses and extravagant personal expenses charged to the company

Tax Fraud

Definition: Willful attempt to evade or defeat taxes imposed by law.

Example: In 2008, actor Wesley Snipes was convicted of failing to file federal income tax returns for several years, which resulted in significant tax liabilities.

Insurance Fraud

Definition: Providing false information to an insurance company to receive unwarranted benefits.

Example: John and Anne Darwin faked John’s death in a canoeing accident in 2002 to claim life insurance and pension benefits. They were later discovered and convicted of fraud.

Bank Fraud

Definition: Engaging in a scheme to defraud a financial institution or obtain assets under false pretenses.

Example: In the 1960s, Frank Abagnale Jr. impersonated various professionals and forged checks worth millions, defrauding numerous banks before his capture.

Conspiracy to Commit Fraud

Definition: An agreement between two or more parties to engage in fraudulent activities.

Example: The Enron Scandal involved top executives conspiring to hide the company’s financial losses through complex accounting fraud, leading to Enron’s bankruptcy in 2001.

Obstruction of Justice

Definition: Interfering with the administration of law, including influencing witnesses or destroying evidence.

Example: Martha Stewart was convicted in 2004 of obstruction of justice after lying to investigators about a stock sale and attempting to conceal insider trading.

Money Laundering

Definition: Concealing the origins of illegally obtained money, typically by means of transfers involving foreign banks or legitimate businesses.

Example: Bernie Madoff orchestrated a massive Ponzi scheme and was convicted in 2009 for money laundering, among other charges, involving billions of dollars.

Witness Tampering

Definition: Attempting to influence, alter, or prevent the testimony of witnesses within legal proceedings.

Example: Sam Bankman-Fried, founder of FTX, was accused of witness tampering by contacting a former employee to influence their testimony during his fraud trial.

Misuse of Charitable Funds (Self-Dealing)

Definition: Using funds from charitable organizations for personal or unauthorized purposes.

Example: In 2016, the Wounded Warrior Project was accused of misusing charitable funds for lavish staff events and expenses unrelated to its mission, leading to the dismissal of top executives.

Watch and Learn About Ten of the Most Infamous White Collar Crimes:

Common Legal Defenses To White Collar Crime

Falsifying Business Records

Legal Defense: Lack of Intent or Knowledge

The defense may argue that the defendant did not knowingly make or cause false entries, or that the errors were clerical, unintentional, or made by subordinates without the defendant’s awareness.

Tax Fraud

Legal Defense: Good Faith Belief / Honest Mistake

The accused may claim they relied on a tax professional, misunderstood complex tax laws, or made a good-faith error in reporting income or deductions — negating the element of “willfulness.”

Insurance Fraud

Legal Defense: No Fraudulent Intent / Legitimate Claim

Defendants may argue that the insurance claim was valid and any discrepancies were due to miscommunication, mistake, or misunderstanding — not an intent to defraud.

Bank Fraud

Legal Defense: Misrepresentation Was Not Material or Intentional

A common defense is that the representations made to the bank were immaterial, misunderstood, or part of standard business negotiation — not intentionally false or deceptive.

Conspiracy to Commit Fraud

Legal Defense: No Agreement / Mere Association

The defense may assert that there was no agreement to commit a crime — mere association with individuals involved in wrongdoing does not establish conspiracy without proof of shared intent.

Obstruction of Justice

Legal Defense: Lack of Corrupt Intent

Defendants often argue they were unaware that their conduct could be seen as obstructive or that it was done in the normal course of business or legal strategy without corrupt motives.

Money Laundering

Legal Defense: Lack of Knowledge of Illicit Source

The accused might argue they were unaware the money originated from criminal activity or did not intend to conceal the funds’ source, ownership, or control.

Witness Tampering

Legal Defense: Innocent Contact / No Coercion

Defendants often claim their contact with a witness was lawful, non-threatening, and not intended to influence testimony — or that they were exercising their right to communicate.

Misuse of Charitable Funds (Self-Dealing)

Legal Defense: Authorized Use or Administrative Error

It may be argued that the expenses were approved under the organization’s rules, or that alleged misuse was an administrative oversight rather than intentional personal enrichment.

Constitutional Violations and Affirmative Defenses to White Collar Crime

Lack of Intent:

The prosecutor was unable to prove criminal intent.

Example Case: United States v. Goyal, 629 F.3d 912 (9th Cir. 2010)

Case Summary: Prabhat Goyal, former CFO of Network Associates, was charged with securities fraud. The Ninth Circuit reversed his conviction, finding insufficient evidence that Goyal knowingly and willfully intended to deceive investors.

Entrapment: Law enforcement induced the defendant to commit a crime they otherwise wouldn’t have.

Example Case: Jacobson v. United States, 503 U.S. 540 (1992)

Case Summary: Keith Jacobson was convicted of receiving child pornography. The Supreme Court reversed the conviction, ruling that government agents had induced him to commit the crime, constituting entrapment.

Insufficient Evidence:

The prosecution failed to prove all required elements of the crime beyond a reasonable doubt.

Example Case: Case: United States v. Goyal, 629 F.3d 912 (9th Cir. 2010)

Case Summary: Prabhat Goyal, former CFO of Network Associates, was charged with securities fraud. The Ninth Circuit reversed his conviction, finding insufficient evidence that Goyal knowingly and willfully intended to deceive investors.

Duress or Coercion:

The defendant was forced or threatened into participating.

Example Case: United States v. Contento-Pachon, 723 F.2d 691 (9th Cir. 1984)

Case Summary: A taxi driver was coerced into smuggling cocaine under threats to his family. The Ninth Circuit held that duress was a valid defense, as he acted under immediate threat of harm.

Statute of Limitations:

The time limit to prosecute the alleged crime has expired.

Example Case: Toussie v. United States, 397 U.S. 112 (1970)

Case Summary: Toussie was indicted for failing to register for the draft. The Supreme Court ruled the statute of limitations barred the indictment, as the offense was not a continuing one.

Fourth Amendment Violation:

The prosecution violated the defendant’s 4th Amendment rights.

Example Case: United States v. Warshak, 631 F.3d 266 (6th Cir. 2010)

Case Summary: Steven Warshak was convicted of fraud. The Sixth Circuit found that warrantless searches of his emails violated the Fourth Amendment, leading to the suppression of evidence.

Mistake of Fact:

Good faith reliance on a material fact essential to the crime

Example Case: Cheek v. United States, 498 U.S. 192 (1991)

Case Summary: John Cheek argued he genuinely believed he was not legally obligated to pay taxes. The Supreme Court held that a genuine, albeit unreasonable, misunderstanding of tax laws could negate willfulness.

Criminal Defense Trouble Tip

Common Misconceptions About White Collar Crime

Misconception: White-collar crime is victimless.

Truth: White-collar crime can devastate lives. Victims may lose savings, homes, jobs, and retirement funds. Thousands of people were financially ruined in cases like Enron or Bernie Madoff’s Ponzi scheme.

Misconception: White-collar criminals don’t go to jail.

Truth: While some receive light sentences, many white-collar criminals serve time. Bernie Madoff received 150 years. Martha Stewart, Elizabeth Holmes, and Allen Stanford all served (or are serving) prison time.

Misconception: White-collar crimes aren’t as serious as violent crimes.

Truth: Financial crimes can cause widespread harm. A major corporate fraud or insider trading scandal can destroy entire companies, tank stock markets, and affect national economies.

Misconception: Only wealthy CEOs commit white-collar crimes.

Truth: It spans a wide range — from executives to small business owners to mid-level employees. Fraud, embezzlement, and cybercrime are committed at all workforce levels.

Misconception: If there’s no physical evidence, it’s not an actual crime.

Truth: Paper trails, digital records, emails, and financial transactions are all forms of evidence in white-collar cases. In fact, white-collar crime investigations often rely on forensic accounting and data analysis.

Misconception: People who commit white-collar crimes didn’t mean to — it was just bad bookkeeping.

Truth: While honest mistakes happen, white-collar crime requires intent. Prosecutors must prove the individual knowingly misrepresented or concealed information for personal or financial gain.

Misconception: Corporate crimes only harm investors.

Truth: They also hurt employees (layoffs, lost pensions), customers (higher prices), taxpayers (bailouts), and the public (loss of trust in institutions).

Criminal Defense Trouble Tips

Professionals Charged with Crimes

Many individuals prosecuted for white-collar crimes hold professional licenses. White-collar defense lawyers represent many such professionals, including healthcare professionals, lawyers, and real estate professionals.

Criminal Defense Trouble Tip

Professional Licensing Boards

A professional licensing board is any board, bureau, or commission created to license, regulate, and enforce that profession’s professional standards and rules of conduct. Examples include:

- Medical Boards

- Legal Boards,

- Nursing Boards

- Account Boards

- Speech Pathology Boards

- Psychologist Boards

Criminal Defense Trouble Tip

Licensing boards are not criminal courts of law. However, they can restrict, suspend, or revoke a person’s professional license. A recent example is former Mayor Rudy Guiliani, who had his license to practice law suspended in 2022.

Public Officials

America’s Mayor Went Bad

Separate and distinct from the state bar of New York revoking Guiliani’s professional license, he also faces criminal prosecution from state and federal prosecutors for his involvement in election fraud and other incidents of professional misconduct for former President Donald Trump.

Supreme Court Ruling On Holders of Public Officials

The drafters of the 14th Amendment were particularly concerned that a seditious conspiracy by a public official could lead to an overthrow of the federal government.

This concern was articulated in Section 3 of that Amendment, which provides, in effect, that no person holding a public office and having taken the oath of office shall engage in insurrection or rebellion against the government or give aid or comfort to its enemies.

However, the Supreme Court, in its 2024 session in Trump v. Anderson, held in favor of the former president on the application of Section 3 by holding:

We conclude that States may disqualify persons holding or attempting to hold state office. But States have no power under the Constitution to enforce Section 3 with respect to federal offices, especially the Presidency.

Consult With A Criminal Defense Lawyer

Should you have specific questions or require additional information about your legal rights and obligations, we recommend you consult a verified Criminal Defense Lawyer as soon as possible.