Many consumers can find themselves in substantial debt for a host of reasons, including the loss of a job, going through an expensive divorce resulting in the loss of a second income, or suffering a disabling accident resulting in unpaid hospital and medical bills.

Unfortunately, mounting debt can quickly accumulate during these times of financial vulnerability and excessive stress. If you cannot make a payment, especially if it’s already overdue, it can result in the creditor taking aggressive collection and other forms of legal action.

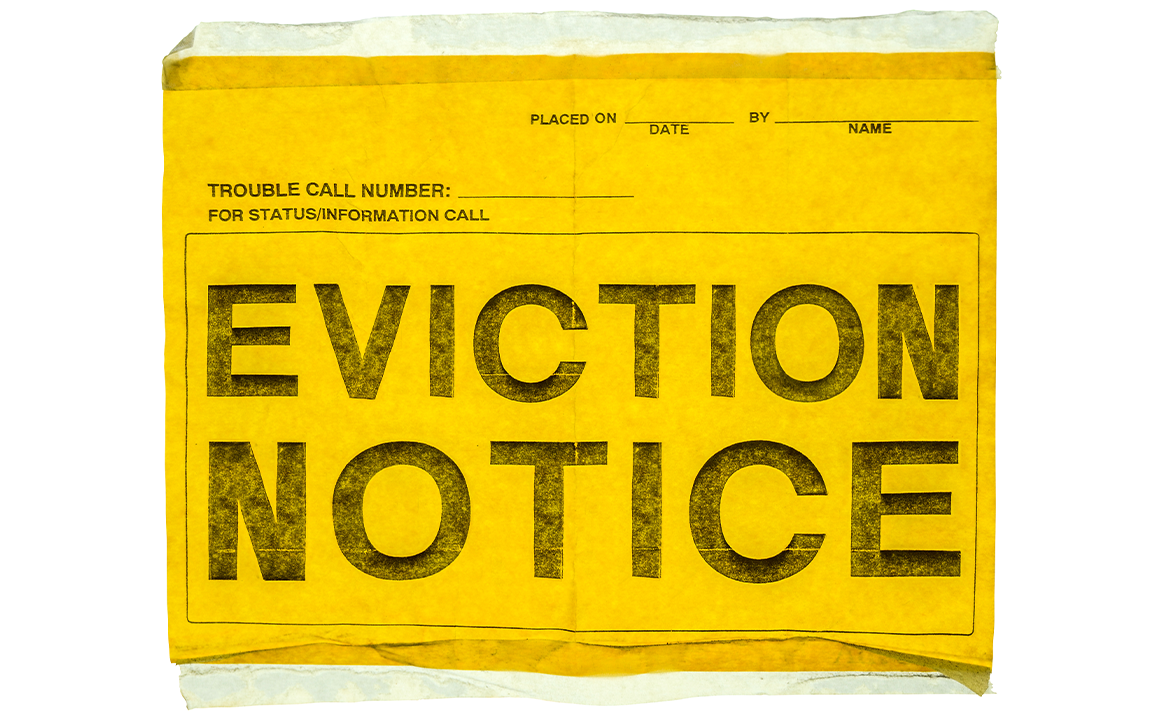

Creditor legal actions can result in eviction, foreclosure, repossession of secured assets, wage garnishment, and attachment of financial accounts.

Difference between Chapters 7 and 13

Filing for Chapter 7 bankruptcy is different from Chapter 13. Chapter 7 is not a repayment plan. It is the liquidation and discharge of the debtor’s debt. The stated goal of Chapter 7 is to provide relief from crushing debt and give an honest debtor a “fresh start.”

While most debts are dischargeable, such as unsecured credit card debts, medical bills, and unpaid rent, certain obligations, such as delinquent support payments and unpaid taxes, are not.

The Chapter 7 Bankruptcy – Liquidation Option

Qualifying for relief under Chapter 7 – Means Test

The debtor must first pass a means test, irrespective of the amount of debt held by the debtor. The means test determines if the debtor has sufficient income to repay their creditors. If not, the debtor can file for bankruptcy under Chapter 7. For more information on means testing, visit the Department of Justice website.

Chapter 7 Bankruptcy Process

Once the debtor files for relief under Chapter 7, the court will appoint a trustee to manage the case. The fundamental role of the trustee is to gather and sell the debtor’s non-exempt assets and use these proceeds to pay the debtor’s creditors under the law of priority.

One of the first tasks of the clerk will be to provide written notice of the debtor’s Chapter 7 case to all of the debtor’s creditors whose names and addresses were provided to the court when the petition was first filed with the court.

The Automatic Stay

Upon the debtor filing the petition, by operation of law, a protective stay, equivalent to a cease-and-desist order, automatically goes into effect, strictly prohibiting all creditors from taking legal action against the debtor or the debtor’s property during the term of the bankruptcy proceedings.

However, certain types of legal actions are not subject to the automatic stay and include:

- civil action or proceeding for the establishment of paternity

- civil action for domestic support, including child custody or visitation

- civil dissolution of a marriage, unless the proceeding seeks to determine the division of property that is property of the bankruptcy estate

- criminal action against the defendant for domestic violence

Debtor Required to Make Full Financial Disclosure

A husband and wife may file a joint petition or individual petition. Even if filing jointly, a husband and wife are subject to all the document filing requirements itemized below.

In addition, the debtor will be required to file a complete set of court forms, including a:

- schedule of assets and liabilities

- schedule of current income and expenditures

- statement of financial affairs

- schedule of executory contracts and unexpired leases

- copy of the most recent tax returns

- certificate of credit counseling

- copy of any credit counseling debt repayment plan

- copy of the debtor’s most recent pay stub from employment

- statement of monthly net income

Exempt Property

Under Chapter 7, the debtor will be allowed to keep certain assets determined by the trustee to be exempt property and, therefore, not part of the bankruptcy estate nor subject to creditor claims.

The rules governing federal and state bankruptcy exemptions are complicated and subject to change. The debtor should consult with their local bankruptcy attorney to determine the current exemptions available under the federal and state Chapter 7 plans.

The following list of federal exemptions is listed as examples only. Many others should be reviewed and explored with your bankruptcy attorney.

The partial list of exemptions below is among the most commonly used under Chapter 7 bankruptcy.

- personal residence up to a specific value

- personal property up to a specific value

- jewelry up to a specific value

- household goods, including furnishings, appliances, clothes, books, animals, crops, and musical instruments up to a specific and aggregate value

- tools of the trade up to a specific and aggregate value

- domestic support (fully protected)

- public benefits and assistance (fully protected)

- wildcard exemption: The wildcard exemption, as of April 1, 2022, was set at $1,475 plus any unused federal homestead exemption up to $13,950.

Non-Exempt Property

The general rule in Chapter 7 of federal bankruptcy cases is that any property not protected in bankruptcy is considered non-exempt property and, therefore, can be sold by the trustee to satisfy creditor claims.

The following are examples of common federal non-exempt property classifications:

- family heirlooms

- cash

- bank accounts

- stocks and bonds

- stamp and coin collections

- private investments

- second vehicle

- second home

Meeting of Creditors

The court-appointed trustee presides over the meeting of creditors, also known as a 341 hearing. All creditors and parties listed on the bankruptcy schedules receive notice of the meeting but rarely do creditors actually attend the hearing. The major reason is that the meeting is not considered an official court hearing and has little to no legal effect.

The main purpose of the meeting is for the trustee to review debtors’ bankruptcy schedules and to determine if any of the assets listed can be construed within reach of the creditors. Meaning a particular item is actually a non-exempt asset.

Upon conclusion of the meeting, unless there is more the trustee wishes to know or investigate, the petition is finalized, and the debtor awaits their notice of discharge of all debts.

Final discharge of debts

Once the individual receives notice of discharge, the case is technically over, and those creditors named in the petition are forever prohibited from taking any further formal or informal action against the debtor.

Reference Source: U.S.courts.gov