Divorce Decree and Child Support Obligations

Upon the conclusion of your divorce proceedings, the divorce decree will clearly state the responsibilities of the parent paying child support, often referred to as the paying parent.

This decree not only resolves issues around the amount of child and spousal support to be paid but also sets forth directives for handling various child support matters.

Knowing your child support options after a divorce is important to ensure your child’s well-being. Even after the divorce is final, and your divorce decree and child support obligations have been duly ordered, as time passes, things can change, like shifts in income, job loss, or your child’s growing needs.

Understanding your legal options can help you seek adjustments to the child support agreement, ensuring that your child’s needs are always met.

Additionally, being well-informed helps you navigate the legal system more efficiently, minimizing stress and anxiety, as well as potential conflicts with your former spouse.

This article aims to dispel common myths about child support following a divorce and guide you through the legal process of seeking modifications if needed.

Common Misconceptions About Post-Divorce Legal Actions

One common misconception is that all financial and custodial arrangements are set in stone once the divorce is finalized. This is not true. Many aspects, including child support, can be revisited if circumstances significantly change.

Another misunderstanding is the belief that only the custodial parent can request modifications to child support when, in fact, both parents have the right to seek adjustments depending on their financial situations and the needs of the child.

Additionally, some parents may think that informal agreements between them are sufficient. However, to ensure enforceability, any changes to child support should be officially documented and approved by the court.

Can I File for Child Support After the Divorce is Final?

You can file for child support after the divorce is final if significant changes like increased living costs, medical expenses, or major income shifts occur. To adjust the support terms, follow legal procedures by requesting a formal review through the court.

In this regard, consulting with a divorce law attorney is highly advisable.

How to File for Child Support After Divorce

What Are the Conditions for Filing

Several situations might require filing for child support after a divorce is finalized. One key reason could be a significant change in either parent’s financial status. For example, if a parent gets into a car accident resulting in a disabling injury, loses their job, or takes on new financial responsibilities, these changes could warrant a reassessment of child support payments.

Additionally, child support can be adjusted if the child’s needs change over time. This might include increased expenses for education, medical treatments, or extracurricular activities that weren’t initially anticipated.

It’s also important to note that if previously undisclosed financial assets or sources of income for the non-custodial parent are discovered, support payments can be reviewed and adjusted accordingly.

These legal changes are designed to ensure that the financial support meets the child’s current and evolving needs, promoting the child’s well-being and development.

This process helps maintain fairness and adequacy in the financial responsibilities shared by both parents while ensuring the child’s best interests are being served.

Documentation Required for Filing for Child Support

When filing for child support after a divorce, you will need to have the necessary documentation to ensure an accurate review and child support assessment.

First and foremost, you’ll need to provide proof of your financial situation.

This includes recent pay stubs, tax returns, and other income sources such as bonuses, commissions, or health benefits. If you’re self-employed, detailed records of your earnings and business expenses will be required.

Additionally, you’ll need to submit evidence of the child’s expenses. This can encompass receipts and invoices for educational fees, medical bills, childcare, extracurricular activities, and other relevant costs.

Documentation of any agreements or court orders from the initial divorce settlement related to child support is also necessary to provide the necessary context for the requested changes.

Providing the court with comprehensive documentation facilitates a smoother legal process and helps build a compelling case for any adjustments sought. Your family law attorney will ensure all required documents are correctly prepared and submitted, increasing the likelihood of a favorable outcome.

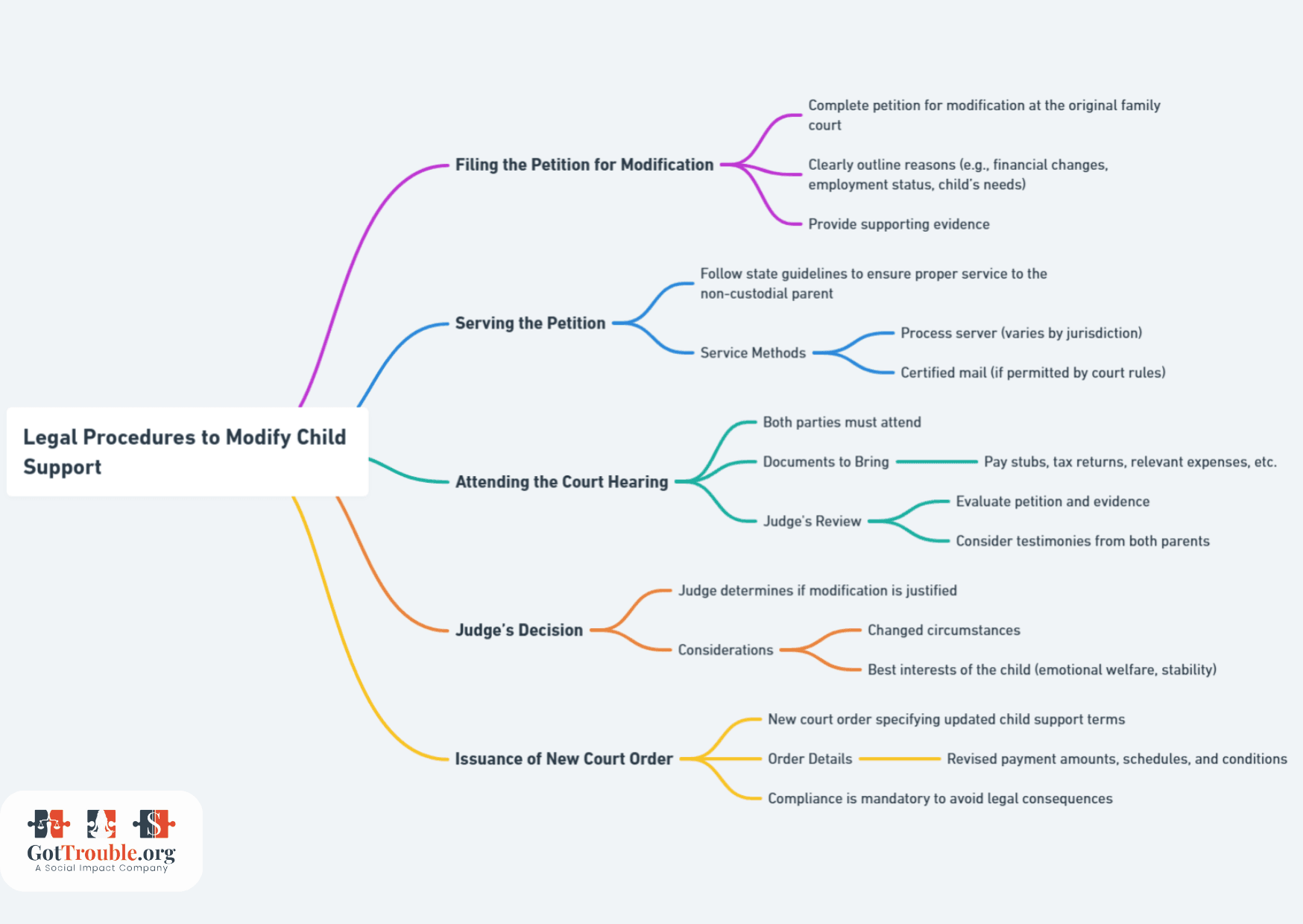

Legal Procedures to Follow

Filing a motion to modify child support involves completing and filing a petition for modification at the family court that issued the initial support order. This petition must clearly outline the reasons and present evidence for the requested change.

Below, you will find a step-by-step guide to making sure the petition for child support changes becomes legally binding and enforceable:

- Submit a Petition: Start by submitting a detailed petition for modification to the family court that handled your divorce. This petition should outline why you believe a modification is necessary, including any changes in financial circumstances, employment, or the child’s needs.

- Serve the Petition: Follow your state’s legal guidelines to ensure the non-custodial parent is properly served with the petition. This ensures they have a fair chance to review the petition and prepare a response. Properly serving your petition will usually require a process server, depending on your jurisdiction. Make sure to check your court’s rules. In some jurisdictions, service of the petition may be made by certified mail.

- Attend the Court Hearing: Both parties must attend a scheduled court hearing. Here, a judge will review the petition, examine any supporting evidence, and listen to testimonies from both parents. Ensure you bring the originals of your documentation, such as pay stubs, tax returns, and any relevant expenses, to support your case.

- Judge’s Decision: The judge will determine if a modification is justified based on the presented evidence of changed circumstances. This decision will be based on the child’s best interests, including the child’s emotional welfare and stability.

- New Court Order: If the judge approves the modification, a new court order with the updated child support arrangements that both parties must follow will be issued. This new order will specify the revised payment amounts, schedules, and any other pertinent conditions. Compliance with this order is mandatory, and failure to adhere to it can result in legal consequences.

Statistic: An Office of Child Support Enforcement study found that 2018 child support collections totaled $32.7 billion, benefitting 14.7 million children. More details are in the Office of Child Support Enforcement annual report.

Legal Tip

Statistic: According to the U.S. Census Bureau, in 2017, only 45.9% of custodial parents received the full amount of child support owed to them.

Potential Challenges In Child Support Cases

Challenges in child support include dealing with uncooperative non-custodial parents, who may refuse to make payments or engage in communication.

Financial decline and hardship affecting both parents can complicate the situation further. The custodial parent may struggle to meet the child’s needs, while the non-custodial parent also faces financial difficulties.

Additionally, the complexity of legal procedures can be overwhelming, often requiring significant time, effort, and resources to navigate successfully.

Enforcement of Child Support Orders

The most effective methods for enforcing child support orders vary depending on your state’s laws and resources. However, many states use a combination of the following commonly effective methods:

- Income Withholding: Most states use income withholding as the primary method for collecting child support. Sometimes referred to as wage garnishment, this method allows payments to be automatically deducted from the non-custodial parent’s paycheck.

- Tax Refund Interception: Federal and state tax refunds can be intercepted to cover past-due child support. This is an effective way to collect large sums of overdue support.

- License Suspension: Suspending driver’s and professional licenses can strongly incentivize non-custodial parents to pay for their child’s support.

- Property Liens: Placing liens on property, such as real estate or vehicles, ensures that the non-custodial parent cannot sell or refinance their property without settling their child support debt.

- Bank Account Seizure: States can seize funds directly from the non-custodial parent’s bank accounts to cover unpaid child support. This is particularly effective for collecting lump sums.

- Credit Bureau Reporting: Reporting unpaid child support to credit bureaus can negatively impact the non-custodial parent’s credit score, motivating them to make payments to avoid damage to their credit profile.

- Passport Denial: Denying passport applications or visa renewals for non-custodial parents who owe significant amounts of child support can be an effective measure, especially if the parent plans to travel internationally.

- Contempt of Court: Courts can hold non-paying parents in contempt, leading to penalties such as fines or jail time. This method is effective as a last resort to compel compliance.

Trouble Tip

Tips for Overcoming Child Support Challenges

Maintain Detailed Records

Thoroughly document all child support payments, communication with the other parent, and any financial changes. This information is crucial for resolving disputes and presenting evidence in court.

Open Communication Channels

When possible, maintain open communication with the non-custodial parent. Clear and respectful dialogue can often resolve issues without legal intervention, fostering cooperation. This is where having a high Emotional IQ by both parents can make a huge difference in the child’s and parent’s lives.

Legal Tips

People Also Asked:

Can both parents request changes to child support?

Yes, both custodial and non-custodial parents have the right to request adjustments to child support based on their financial situations and the needs of the child.

Are informal agreements between parents valid?

Informal agreements may be valid between the parents, but that does not mean they are legally enforceable. Any changes to child support should be documented and approved by the court to ensure they are binding.

Who pays child support if the father is in jail?

When a father is incarcerated, child support obligations typically continue but may be adjusted based on reduced income. Some states temporarily suspend payments, which resume upon release. The custodial parent must notify the court and seek legal advice to ensure the child’s best interests are protected.

Can you lose custody of your child for not paying child support?

Failure to pay child support does not automatically result in losing custody, as they are separate legal matters. However, consistently missing payments can impact a parent’s standing in court by reflecting on their overall fitness and commitment to the child’s well-being.

Courts prioritize the child’s best interests, considering emotional, physical, and financial stability factors. Therefore, addressing financial difficulties promptly and seeking legal assistance to modify support orders is crucial.

Conclusion

Navigating post-divorce child support can be challenging, but there are plenty of tools and legal resources available to you. Legal resources such as child support enforcement agencies and family law attorneys offer vital support in establishing, modifying, and enforcing child support orders.

If you’re facing child support issues, seek legal help immediately. An experienced family law attorney can guide you through the process, protect your rights, and ensure your child’s best interests.

References

- U.S. Department of Health and Human Services. Office of Child Support Enforcement.

- National Child Support Enforcement Association (NCSEA).

- American Bar Association. Family Law Section.