Life throws us into financial chaos: termination from a job, accident-related medical bills, or just trying to keep up with rising costs. In those moments, being frugal can be more than just a survival strategy; it can be a path to economic happiness.

The concept of frugality has become increasingly popular in recent years. Many people embrace the idea that “less is more.” But how can focusing on frugality help you live a better life? There are several ways to save money while simultaneously improving your overall lifestyle.

Financial security is one of the critical components of a happy and fulfilling life. Many think they have to make tons of money to achieve financial happiness. This is not necessarily true. Instead, learning how to manage your money wisely is more important. That is where frugality comes in – by making smart decisions about your financial future, you can create a secure lifestyle for yourself and your family.

At GotTrouble.org, we believe that navigating tough times requires a whole-person approach. That means addressing not just your financial problems but also the impact on your legal rights, emotional well-being, and overall quality of life. It can change your relationship with money and lead to long-term economic happiness.

Whether you are looking to pay off debt or want to start living within your means, here are some tips to get you started on the path toward frugality.

What is Frugality?

Frugality is about understanding how much you must spend each month and ensuring that your expenses don’t exceed this amount. Making frugal decisions helps you save money on everyday purchases and larger ones like vacations or home improvements. The goal of frugality is saving money and spending it on things that will make you happier in the long run.

In a nutshell, frugality implies:

- reducing waste

- seeking long-term efficiency

- challenging expensive social norms

- embracing cost-free options

- resisting advertisement manipulation

- avoiding costly and unhealthy items

Being frugal doesn’t mean living a life of deprivation. Being frugal can lead you to a happier and more fulfilling life. It is not about being cheap; it’s about being smart with your money. Frugality is a mindset that can lead you to a life of greater peace and happiness.

A frugal person assesses their desires and spends less on things they don’t need. A cheap person goes for the lowest price without a thought of quality. Both are exclusive concepts.

Statistic: According to Bankrate’s recent Annual Emergency Savings report, 56 percent of Americans surveyed said they wouldn’t pay for an emergency expense of $1,000 or more from their savings. Saving at least a few months’ worth of expenses can help you avoid building up greater debt in the future.

The Benefits of Living Frugally

One of the most obvious benefits of living frugally is that it helps you save money! By being mindful of what you are buying, you can build up your savings account quickly and easily. Additionally, it allows you to focus more on experiences rather than material possessions – which research has shown makes people much happier overall.

Another benefit of living a frugal lifestyle is that it teaches us patience and delayed gratification. When we are forced to wait for something we want due to limited funds, we learn valuable lessons about self-control and delayed gratification – two traits that will set us up for success in all areas of life.

Frugality reduces stress. We live in a consumer-driven society, and getting caught up in the latest trends is easy. However, this can be incredibly draining on our finances and mental health. By being mindful of how much you are spending, you control stress by eliminating the pressure to keep up with your neighbors and friends.

By living frugally, we do our part to contribute to a healthier environment. Frugality can be an effortless way of reducing our carbon footprint as we spend and create less waste while being more thoughtful about the resources we consume. Therefore, authentic frugal living is often associated with eco-friendliness.

Lastly, we become more aware of our finances – from how much debt we carry to our credit score – which leads us toward economic freedom and stability. We focus on what matters.

How to Get Started with Frugality?

Living a frugal life may seem intimidating, but it doesn’t have to be. With the right mindset and tools, anyone can learn to become frugal.

Here are some tips to get you started:

Create a Budget and Stick to It

One of the most critical steps when living frugally is determining what money you have coming in monthly and allocating it accordingly. Keeping track of all your expenses will help ensure that you never overspend. Additionally, include room for saving in your budget, so unexpected expenses will be manageable.

Unlock economic happiness by creating an honest budget. Take the time to add up your monthly income and subtract your fixed expenses (like rent, utilities, and car payments). Suppose money is left over after these fixed expenses. You can allot a portion for discretionary spending (such as eating out or shopping). This budget should be realistic and achievable so you don’t get discouraged if you can’t stick to it.

Be Smart About Shopping

Non-essentials like clothes or household items kill budgets. Look for sales at stores, take advantage of coupons when available, and shop around online before making large purchases. Today, you can order from discount online pharmacies for about half the costs of brand name presritpions. It ensures you get the best price possible while still getting quality items.

Additionally, consider investing in higher-priced assets like furniture or appliances. These items may cost more upfront but last longer than cheaper alternatives. It means you won’t have to fix and replace them as often (which implies spending additional money).

Don’t just settle for the first price you come across. Take some time to compare prices at different stores before making any purchases. You may find that one store has a better deal on an item than another store. You could save money by buying generic brands instead of name brands.

Additionally, consider shopping online because websites like Amazon and eBay often offer competitive prices on items that would be more expensive in stores.

Look for deals and coupons that reduce your total cost when shopping online or in stores. Subscribing to newsletters from stores is a great way to stay informed about current deals and discounts at those establishments. Additionally, downloading apps such as RetailMeNot can help you locate further discounts from retailers near you.

Keep an eye on groceries, as they are one of the most significant expenses for many households.

Statistic: Environmental Impact: The EPA states that reducing food waste could save the average household approximately $1,800 annually.

Live Within Your Means

One key component of a frugal lifestyle is learning to live without relying on credit cards or loans for extra funds. Debt can quickly add up and make it difficult (if not impossible) to pay off down the road, leading you into an even bigger financial crisis than before!

The United States economy embraces capitalism, encouraging individuals to spend as much as possible. In the US, it became a right to go into debt as deep as possible. “Get it now, pay later” became so common that most Americans cannot imagine going to college without a student loan or purchasing a car from personal savings. As we can see in many European countries, it is possible to do so.

In Sweden, students get paid through grants from September to June since the government considers education a long-term investment for the nation’s growth. Now, every country has its economic specifics, and the purpose of this illustration is not to compare them but to put into perspective a different vision of money spending.

The goal is to understand where every dollar goes – whether it be towards rent/mortgage payments, groceries, bills, or debt repayment – to have more confidence in your life decisions moving forward and avoid getting into financial trouble. Of course, the US government will not start financing your college education by tomorrow. But instead of taking out a student loan, why not find a part-time job?

If you have debt, it is time to start paying it off quickly. Always prioritize your highest-interest debts to save money in the long run. As a rule of thumb, only purchase if you need it. Don’t buy what you can’t afford. Avoid credit cards if not necessary. And, of course, never go for any impulse buying.

Simple Steps to Frugality

Financial frugality is not as daunting or complex as it may seem. It requires discipline, but if done correctly, you can save money while enjoying the items you want. Or to be more accurate, the items you “need.”

Get started with frugality with easy wins as follows:

- don’t pay what you can get for free!

- cap your spending

- think long-term

- grow your veggies

- use coupons and loyalty programs

- cook in bulk

- keep your leftovers for a next meal

- cut down on eating out

- rent a tiny home instead of owning

- use LED lightbulbs

- buy second-hand items

- pawn stuff that you don’t need anymore

- reuse and recycle (e.g., packaging)

- barter services with neighbors and friends

- cancel monthly subscriptions

- use water and gas utility apps

- prioritize cost-free leisure activities

Statistic: Energy Conservation: In 2023, 55% of U.S. households implemented energy-saving measures, such as using LED bulbs and energy-efficient appliances, to reduce utility bills.

In the United States, depending on your income, you can receive financial help paying for your utilities by applying for energy assistance.

Frugality is a lifestyle choice that comes with great rewards. When you start living frugally, you will be more at ease and less stressed, apart from saving more money every month. You will enjoy life better while still being able to afford the things that bring joy and happiness into your life – even if they are small. Knowing how to handle your finances makes all the difference in the world! Try these steps today and experience financial freedom for yourself.

The Frugal Mindset

The need for financial security and happiness drives most people who practice frugality. They clearly understand that their actions today will affect their future well-being.

The biggest challenge about living frugally is not finding ways to do so. The list we shared above is attainable. The real problem comes from the mindset: are you psychologically ready to be frugal?

“So, you tell me you can’t join our student party because you are working at McDonald’s tonight?”

“Oh my god, you haven’t bought your first house yet?”

“Everybody wears this brand. Don’t you mind looking homeless?”

The social pressure is enormous. We are encouraged to seek wealth in a capitalistic country like the US. If self-made men often started their lives by cutting costs, the media popularized them once they became rich. At this point, they usually enjoy life by becoming bigger spenders since this is what they struggle for.

So, the very first step to frugality is not to start applying our tips. You need to convince yourself this is what you want to do and be ready for the “social consequences” that will most certainly occur.

It is up to you whether to live frugally or not. What is important is not who you are and how you look but what you do and how you feel about yourself.

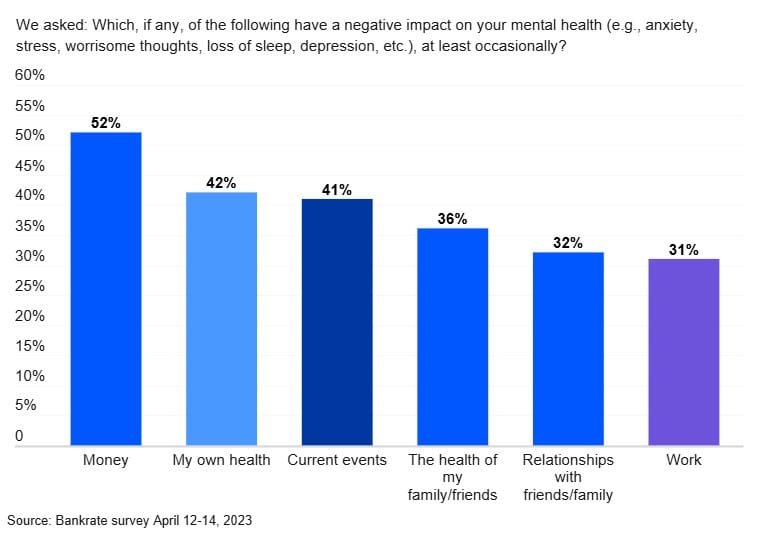

Money is the most cited factor that has a negative impact on U.S. adults’ mental health.

The Frugality’s Road to Happiness

Living frugally doesn’t have to mean sacrificing quality or style — it simply means being smarter with handling your finances and being aware of where every dollar goes each month. With patience and dedication, following these tips should eventually lead you toward economic happiness! With proper planning and discipline, anyone can learn how to save money while enjoying simple pleasures without breaking the bank.

Living a frugal lifestyle isn’t about depriving yourself. It is about being smart with your money so that it works for you rather than against you. Making an honest budget and shopping for better deals are two great ways to save dollars. Additionally, taking advantage of available discounts helps reduce overall costs when purchasing online or in physical stores.

With the right attitude and mindset shifts, anyone can achieve their dream of financial freedom!

Statistic: A study published in the Journal of Positive Psychology found that individuals prioritizing experiences over material possessions report a 57% higher level of happiness, which aligns with the frugal mindset of spending wisely on meaningful experiences rather than unnecessary goods.

You’re Not Alone: Resources You Might Need

You don’t have to go alone. Here are some resources:

- Legal Aid: If you are facing financial crises like foreclosure or bankruptcy. Get legal advice to learn about your rights from state-wide legal aid offices.

- Community Programs: Many organizations offer free or low-cost resources – food banks, housing help, and credit counseling.

- Mental Health Support: If financial stress is getting to you, talk to a counselor or therapist.

People Also Ask

What are some eco-friendly aspects of frugality?

Frugality aligns with sustainability by reducing waste, reusing resources, and limiting excessive consumption. Practices like buying second-hand, cooking in bulk, and conserving energy lower your carbon footprint.

Does frugality really improve my mental health?

Yes, reducing financial stress and living within your means has been shown to specifically improve mood, relationships, and mental well-being.

Frugality Myths

Myth #1: Frugality Means Deprivation and Requires Extreme Measures

Reality: Frugality is about spending on what matters to you, not about living without joy or comfort. Simple things like budgeting, cooking at home, and using coupons can make a big impact without drastically changing your lifestyle.

Myth #2: Frugal People Are Cheap and Only Poor People Are Frugal

Reality: Frugality is about value and quality, not being cheap, where you sacrifice everything for low cost without thinking about the long term. People of all income levels practice frugality to achieve their financial goals, reduce waste, and create wealth.

Myth #3: Frugality Can Kill Your Social Life

Reality: Frugality encourages creative ways to connect, like potlucks or cost-free activities with friends.

Frugality Fears

Fear #1: I’ll Be Judged for My Choices

Reality: Yes, social pressure exists, but many people respect those who take control of their finances and live authentically.

Fear #2: I Won’t Enjoy Life as Much

Reality: Frugality shifts focus to meaningful experiences and reduces debt burden so you can enjoy life more.

Fear #3: It’s Too Hard to Be Frugal

Reality: Starting small and building habits gradually makes frugality sustainable and easier to integrate into daily life.