Conflicts Over The Right To Inherit

When you make a will, you affect your family’s future, which is usually a sensitive subject. So it’s advisable to begin by finding out what kinds of issues may arise when making decisions about who and under what terms your inheritors will receive a share of the inheritance.

Also, learn why it’s important to give particular legal attention if one of your beneficiaries is a minor. This article will begin by covering the topic of joint tenancy and its potential impact on wills.

Legal Impact of Joint Tenancy On Wills

How A Joint Tenancy Can Bypass A Will

My fathers will left me all of his property, but at his death, the title to his home was held in his name and my sister’s name as “joint tenants. My sister now claims the home is hers. Is she right?

Yes. Any property your father owned with another person as joint tenants (or with his spouse as tenants by the entirety) passed automatically to the surviving joint tenant upon his death.

Can One Spouse Leave Another Spouse Out Of The Will?

When Former And Current Spouses Collide

Dad died last month, leaving a small gift to his second wife and the rest of his estate to me. His second wife claims she is entitled to some of the property dad has left me. Does she have a case?

Yes – if they resided in a “separate property” state at the time of your dad’s death. In almost all separate property states, the surviving spouse is entitled to a statutory “forced share as a matter of public policy.” This usually amounts to one-third of the deceased spouse’s estate.

Uniform Probate Code

States that have adopted the Uniform Probate Code employ a highly complex formula that considers many factors, including the length of the marriage, in determining the surviving spouse’s forced or elective share.

Forced Share Not Allowed In Community Property States

Within states that follow community property law, the surviving spouse will generally have no right to a forced share because the surviving spouse already owns half of all community property. Assuming the spouse acquired the property through marriage, making it community property.

When A Will Is Created Before Marriage

Consider The Following Estate Conflicts

I married John 3 years ago. When we married, he had three children from a prior marriage. One of his children from the previous marriage, Jack, is now ten years old, and under that will, Jack was given John’s entire estate.

John never revised his old will nor made a new one when we were married. John died last week. Do I have any rights to John’s estate?

Probably, if the person with a will marries and never revises his will, the law in many states will presume the testator inadvertently failed to provide for his new spouse.

If you and John resided in a community property state, you would most likely be entitled to all the community property acquired during your marriage.

Divorce Revokes The Will of The Former Spouse

In many states, the law presumes that after a divorce, assuming there was no rewriting of the will, the law may assume there was no intention to provide for the divorced spouse.

Depending on the state, this would mean that your dad’s will is probably still valid but that your mom, the former spouse, will be treated as if she had died before him. Thus, she will not be permitted to receive anything under the will.

In some states, a divorce will entirely revoke the will, meaning that the decedent died intestate.

Giving Special Attention To Minors

Who is legally Considered a minor?

A “minor” is someone who has not reached the “age of majority” – i.e., who is not yet recognized by the law as an adult. The age of the majority varies from state to state.

Minors Lacking Legal Capacity

Minors are said to lack the legal capacity to manage the property. If you want to give property to a minor during your lifetime or through your will, you should select the best method possible.

When The Will Expressly Disinherits A Child

No Obligation To Leave Children An Inheritance

Dad’s will left me all his property. My younger brother is upset and claims Dad had no right to disinherit him. Is he right?

No. A parent is generally under no obligation to leave his children anything. Your younger brother would have no claim to any of the assets in your dad’s estate unless he was born after your dad executed his will. This exception is intended to prevent the inadvertent disinheritance of a child born after a will is executed.

What Is The Best Way To Give Property To A Minor?

The Law Of Direct Transfers

I want to give property to my young grandchildren. What should I do?

The direct transfer method works well if the property is of relatively low value (for example, traditional birthday or holiday gifts, such as clothes or musical instruments).

However, if you give a minor a significant amount of property (sums over $1,000 or $5,000, depending on the state) or the property requires management, a direct transfer to the minor will require a court to appoint a “guardian” to manage the minor’s property. This requires a lawsuit and court involvement and thus might be costly and time-consuming.

In addition, any guardianship will end when the minor reaches the “age of majority” (18 or 21, depending on the state), possibly before they are mature enough to handle the property prudently.

Avoiding The Need For A Guardian

Establishing A Trust

If you leave a minor a substantial amount of property, the best device to use is trust, either a trust you establish during your lifetime or one you write into your will.

In either case, you can name the person whose fiduciary responsibility is to manage the property responsibly on behalf of the minor. This person is called the “trustee.”

You can also spell out exactly how you want your property used for the minor and when and how it should be distributed.

Can I manage the minor’s property without setting up a trust?

Alternatives To A Trust

I don’t want to go through the trouble of establishing a trust, but I want to give my grandchildren property that can be used for their education. What can I do?

Uniform Transfer To Minors Act

As an alternative to a trust, you could transfer your property to a “custodian” for your grandchildren under the Uniform Transfer To Minors Act, which is adopted in most states.

Under the Act, you can make a gift to your grandchild and retain the management by naming yourself or another person to serve as custodian.

The custodian will manage the property for the benefit of the minor and then distribute any remaining property to the minor when they reach the age of majority (or age 25, in some states).

Although not achieving all the benefits of a trust, transfers under the Act are cost-effective, simple to make, and less complex – because most of the terms of the arrangement (including the custodian’s powers, duties, and responsibilities) are set out in the Act.

Low-Value Transfers

Custodianships are often used when the value of the transferred property is too low to justify the costs of a trust.

However, because the property transferred under the Act must be distributed to the beneficiary at the age of majority (or age 25 in some states), it is not wise to use this device if a significant amount of property is to be transferred.

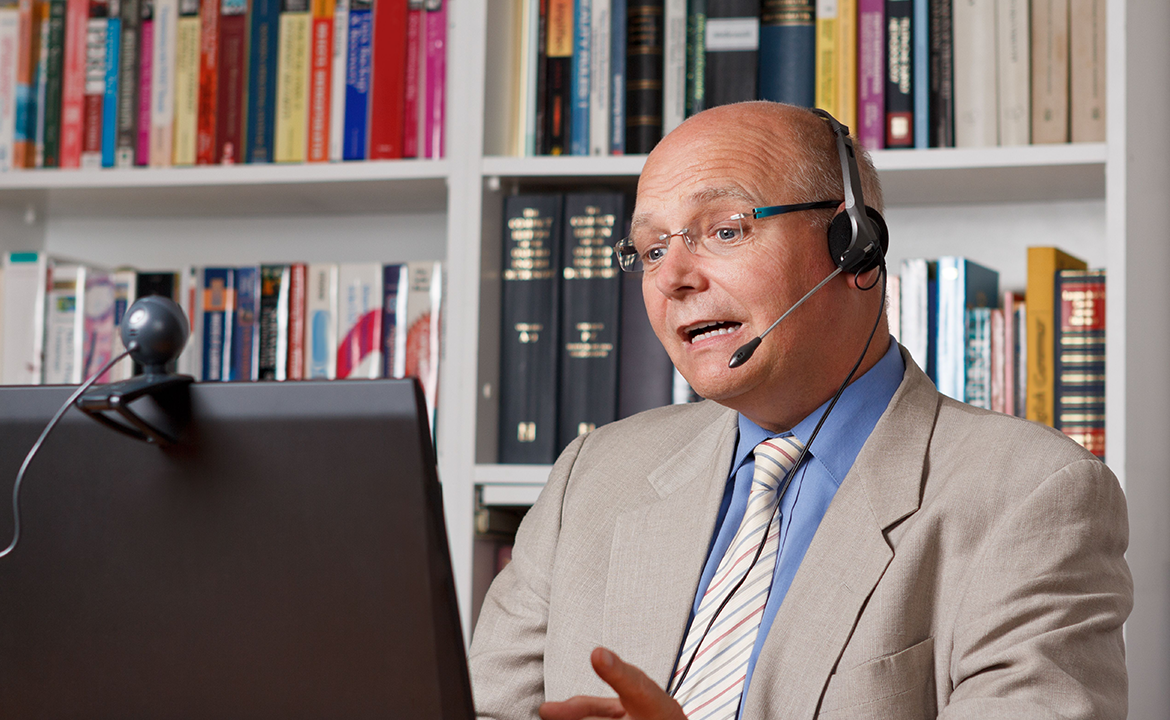

You are not legally required to use a lawyer, but a lawyer experienced in estate planning can help you make your gift in a way that accomplishes what you want and minimizes taxes. An experienced estate planning lawyer can advise you on which device best suits your situation.

Retaining A Wills & Estate Lawyer

If you have questions or require additional information about your specific legal rights and obligations, we advise you to consult with a verified online Wills And Trust Lawyer to discuss your specific issues.