What You Need To Know Before Buying Or Leasing A Vehicle

For most consumers, nothing is more exciting than purchasing a new car. There are just so many makes, styles, and features to choose from! There are also important financial issues to consider.

Everyone has different vehicle needs. Some people buy purely for the pleasure of driving a new vehicle, others buy a new vehicle primarily for business and tax purposes, and some buy a new vehicle for pleasure and business.

A review of your options will help ensure you make smart car-buying decisions based on your needs and goals. Let’s begin by understanding the difference between buying and leasing a new vehicle

Buying Versus Leasing A Vehicle

Whether you buy or lease your new car depends on several factors. If you like to get a new car every few years and don’t drive more than 15,000 miles yearly, leasing might be the best way to go.

You will want to ensure that the lease term is not longer than three years unless you plan to drive the vehicle for longer. You must also ensure that the lease’s mileage will cover the miles you intend to drive annually. Getting out of your car lease early can be very costly.

Advantages of Leasing Your Vehicle

One advantage of leasing is that it usually requires less money down and usually gives you a lower monthly payment depending on the lease term. In addition, there might be tax advantages for leasing your car, especially if it is going to be used for business. It is best to check with your accountant to see if leasing the vehicle would be more advantageous.

What is a “residual” on a leased vehicle?

The residual is the dollar amount the bank guarantees your new car will be worth at the end of the car lease as long as you stay within the lease terms. At the end of your car lease, this is the amount you would pay for the car if you wanted to purchase it, plus tax, license, and any other applicable fees.

The residual is set by the bank and is a percentage of the manufacturer’s suggested retail price (MSRP), regardless of the vehicle’s actual purchase price. Residual is not negotiable as the bank is guaranteeing the value of the car, assuming you stayed within the terms of the lease at the end of the car lease. If the car is worth more than the residual, you might want to buy it, sell it, or trade it in.

If the value is less than the residual at the lease end, you can give it back to the bank and not be responsible for anything so long as you have stayed within the lease terms.

Advantages of Buying The Vehicle

If you are going to purchase an automobile, go with the shortest-term loan you can. It’s always wise to be pre-qualified for the loan before going to the dealer. Your bank or credit union is an excellent place to start. There are many online resources for auto loans as well. These resources are described later in this article.

It is best to purchase your new car if you intend to keep it for a long time or if you anticipate driving many miles per year.

Qualifying for a loan before you buy the car

Most dealerships have several lenders they work with, including what is called factory financing. Usually, if there is a special interest rate, it would be in place of offering a factory rebate to the buyer. If you have a loan in place before you go to the dealership, you can use this fact to your advantage.

You will know that you qualify for an auto loan and how much more you can qualify for should you add options or decide on a different model. It is best to compare interest rates with the dealer to ensure you get the best possible interest rate. This way, you can also explore whether you should take advantage of the special factory financing or the factory rebate, if applicable. But be careful in how you approach this with the dealer.

The best strategy is to avoid talking about payment with the dealer. Instead, talk about the vehicle price and the interest rate. Do not hesitate to use dealer financing if it is competitive. This is one place a dealer can make money, so they might be more inclined to work with you on the price of the vehicle.

Refrain from using your pre-approved loan

If the dealer has a program equal to or better than the one you have in place, it just makes sense to use the dealer financing. The exception is if you are purchasing the vehicle for business. Often it makes more sense financially to lease but check with your accountant to help you decide if you should lease or buy.

Reading The Contract or Lease On New Vehicles

Do you need to read every word?

The amount of paperwork can be overwhelming. It is the finance manager’s job to explain all documents before you sign them. However, your responsibility as a consumer is to ensure that you have read and understood what you’re signing.

In most states, the contracts and paperwork you sign when purchasing a new car are heavily regulated and cannot be altered by the dealer. You should still read everything before signing it.

Other than the purchase or lease agreement, the most relevant document is the “Due Bill,” also referred to as the “We owe/You owe ” document.

The “due bill”

The Due bill should have all of the deal’s major promises, additions, or subtractions on it and be signed by both parties and it should be signed by both parties.

The legal paperwork is intimidating mainly because there is just so much of it, and by the time you finally sign all the documents, you are mentally and emotionally exhausted.

The essential terms must be known and understood

However, you should never complete the deal without knowing these essential terms you need to know at the conclusion of the deal are:

- The length of the lease or payment schedule

- The interest rate

- The price of the monthly lease or purchase payment

- The aftermarket products promised you

- Whether an extended service warranty comes with the vehicle

- If it’s a lease, the actual number of allowable mileage and the cost of additional miles

If you do not agree to or do not understand, do not sign anything. For example, if there are any charges that you do not agree to or do not understand, make sure you resolve these issues before signing the deal.

Remember, just because you are sitting in the finance office does not mean that the deal is done.

Trading In Your Car

This tip will address whether you should trade in your old car with a dealer or sell your old car yourself. In terms of saving money, there can be quite a difference if you sell the vehicle yourself versus trading it in with the dealer when you purchase your new car.

Let’s consider the differences between both options:

Trading in my car to buy a new or used car

Whether you are buying a new or used vehicle, many people choose between selling their car to a private party or trading in their old car for a new one. The money can be used as a down payment or to lower the purchase price of a new car.

Here are some car-buying issues to consider.

- If you have a car to trade in, make sure you know your trade’s wholesale and retail value.

- If you are going to trade a car in, understand that you will never get as much for the vehicle in exchange as you would by selling it on your own.

- Dealers will not normally sell the car for less than wholesale value for your trade, less the cost to recondition the car.

- Even if your vehicle is in the best shape, reconditioning the vehicle can still cost $700.00 or more. These costs include a smog check and certificate, a safety check, and detailing the vehicle at a bare minimum.

- There are online resources that can help you determine the approximate wholesale & retail values of your trade.

Trading in my car to the dealer or selling it to a private party

You will almost always get more money selling your car to a private party. However, selling a used car to a private party has many risks. You will have strangers coming to your home to look at it. All of the paperwork needs to be prepared, including DMV documentation, so that liability does not remain in your name. It would help if you did this before dropping your insurance coverage on the automobile.

More often than not, it is rarely worth the hassle and risk of selling the car on your own. Even if you sell it to a family member or friend, it will be your fault if something goes wrong, notwithstanding your relationship with them. And remember, most states require that the seller purchase a current smog certificate upon sale.

The decision to trade in or sell your car is usually based on personal preference. Do you value saving money more than putting your time and effort into selling the car yourself?

Buying A Used Car From A Dealer

Whether buying a new or used vehicle, it’s always best to inform yourself about what you want and what you are willing to spend before walking onto a dealer’s lot. This section focuses on buying a used car and provides additional information you need to know.

Why buy a used car from a dealer?

If you are looking to get a used car, there are many things to consider. If you buy from a private party, you never know precisely what you are getting, but you will usually pay less than a dealer. Buying a used car from a reputable dealer has many advantages. Stringent laws govern what the dealer must do and inspect before they can sell a used car. Learn the difference between pre-owned dealer vehicles.

What is a used car worth?

You can get a price range for used cars by looking online and in the local newspaper for general price ranges. No two used cars are the same – even if they are the same year, make, model, color, mileage & equipment. They have been driven differently and maintained differently and, therefore, will be in different conditions. The condition of the automobile will significantly impact the price and all the other factors combined.

What is a dealer program car?

Program cars are usually used cars the dealer purchased at a car rental service auction. Usually, these automobiles are late models, have low mileage, are in good shape, and carry the balance of the factory warranty.

What is a certified used car?

Certified used cars can be a trade-in, program car, or lease return. When the dealer receives them into inventory, their service department thoroughly inspects them. If, after the review, they can bring the automobile up to the factory standards for certification, they will. At that point, the factory usually offers a unique certified used car warranty.

Certified used cars tend to be late-model, in very good shape, and a bit more expensive than non-certified used cars.

What about buying a “trade-in” from a dealer?

Trade-ins are cars that customers trade to the dealer for a new car. Most dealers can only keep 3 out of 10 trade-ins as the others require too much reconditioning, have too many miles, or are too old. New car dealerships will sell the automobiles they do not want to used car wholesalers, who dispose of them properly or re-sell them.

What is a lemon law buyback?

“Lemon Law Buy Backs” are automobiles the manufacturer has purchased back from an individual under the lemon law. The manufacturer then fixes the problem and sells them at auto auctions as used cars (Fully disclosed). We recommend that you stay away from these. If the situation were that easy to fix, they would not have had to repurchase it in the first place. Usually, these are presented as a “Spectacular deal;” however, buyers beware! For more information on lemon law, visit our consumer section by clicking here.

The Art Of The Deal

All Trump jokes aside, there is definitely an art to buying or leasing a new or used car. This article will help prepare you before you buy a car. Here are four major suggestions that will help you stand a greater chance of getting exactly the car you want at a price within your budget.

Ask lots of questions

Never feel uncomfortable asking your dealer questions. And always remember that you are always free to walk away from the deal. So keep asking questions until you are comfortable that all of your concerns have been addressed.

If that doesn’t work, ask for the price and essential details in writing, and let them know you will review everything and call the next day with your decision.

Many salespeople will do almost anything to prevent you from walking off their lot. That’s because statistically, only one out of every 50 people will return to their dealership and purchase a car from them.

Do not fall for “this deal is only good today.” Unless a factory program ends that day (rebates, special financing, or dealer incentives) and they can prove it in writing, there is no reason they won’t offer you the same deal tomorrow.

If it is a new car and the one you are considering gets sold, the dealer can almost always find you another identical car. However, be careful when walking away from a used car, since no two used vehicles are the same. So, if you found your perfect used car, ask if you can have your own mechanic inspect it, and if the car checks out mechanically, make your decision or risk it being sold to someone else.

Leave emotions out of the transaction

It’s easier said than done but try not to fall in love with a car. In most cases, you need to have the will and discipline to walk from the deal. If not, you stand a good chance of paying too much for the car.

Tell the salesperson upfront that if you find a suitable automobile at a fair price, you will likely purchase the vehicle. This will give the dealer the incentive to provide you with the best possible deal or risk losing your business.

Again, never show your emotions, and always be emotionally prepared to walk from the deal. Walking onto the dealer’s lot with this mindset will make your car-buying experience go smoothly, and in the end, you will get the best possible price for the car you most desire.

Know what you want

The key to buying a car is to come prepared. Know what you want before you walk on the lot. You don’t need to know exactly what the make, model, and color are, but you should have a basic idea.

It is also good to know whether you would like a new car or a used car. Would you rather have a slightly used car that is exactly what you wanted or a new one that might be a little less than what you wanted but is brand new?

Often the payments for a used car can end up the same as a new car. That’s because banks charge higher interest rates for used cars.

Talk price – not monthly payments

Never talk about payments with the dealer. Negotiate only on the price of the vehicle. If a dealer only talks about monthly payments, it usually means they are trying to avoid the real issue – the price of the vehicle. On the other hand, many people finance their cars, and all that matters is getting what they want for a payment they can afford.

Many sales representatives are trained to get you thinking about payment rather than price. But if you do your homework, you will know what price fits your monthly budget. By law, all car loans and lease contracts must fully disclose the price of the car.

In the case of a loan, it will usually be listed as the “cash price” for the vehicle. In a lease, the price will usually be marked as the “cap cost.” which is the base price for the automobile (before tax, license, documentation fee, any other state or local fees, and any dealer-added options) should be precisely what you and the salespeople agreed on.

Terms You Must Know Before Visiting The Dealer

In most car makes and models, there is an average 10-12% markup from the dealer invoice price. Less expensive automobiles have a lower percentage of profit. Luxury automobiles usually have a higher profit margin.

Sticker price

The sticker price is usually located on the bottom line of the factory window sticker and says, “Manufacturers Suggested Retail Price.” Any other sticker will have a bottom-line price that says, “Dealers Price” or “Fair Market Value.” Sometimes the sticker will even resemble the factory sticker. However, rest assured it is not. It is only the dealer’s asking price.

Dealer asking price

Both the dealer sticker and dealer asking prices are almost always inflated. So please don’t pay too much attention to them. It’s wise to inform your salesperson upfront that you will not be negotiating from the dealer’s sticker price. That you will only be negotiating from the dealer’s actual invoice.

Dealer invoice versus dealer MSRP

The Dealer Invoice refers to the actual invoice that the manufacturer sends to the dealer with the vehicle. Each vehicle has a unique invoice. The Vehicle ID number on the invoice will match the vehicle ID number on the car. On the invoice, you will also see the MSRP price.

Don’t get confused.

Sometimes the invoice is confusing and sometimes on purpose! There will be many different numbers on the invoice. Somewhere, however, at the bottom of the invoice and the MSRP price. you will find the actual invoice price. This is the price you want to base your true negotiations on.

The invoice price does not reflect the actual dealer cost due to holdback and factory-to-dealer incentives.

Dealer Holdback

What is dealer holdback? Dealer hold is usually around 1.75% of the invoice price. It is what the manufacturer rebates back to the dealer. This is one of the reasons why the invoice price does not equal the amount the dealer paid for the vehicle. While the dealer does not get a check from the manufacturer for the holdback amount, the dealer does receive a credit (equaling the holdback) towards the dealer’s next car purchase. Not all product lines have dealer holdbacks, and the percentage does vary a little.

Factory-Dealer Incentives

What are factory-dealer incentives?

When the manufacturer has too many of a particular new car model sitting at the factory, port, or dealership, they will incentivize the dealers to move them a little faster.

There are several different programs, and they change regularly. Not all new car models in a product line will have dealer incentives. Usually, the more popular models will not have incentives or lower incentives because they do not need extra help to sell them.

Dealer-offered extended warranties

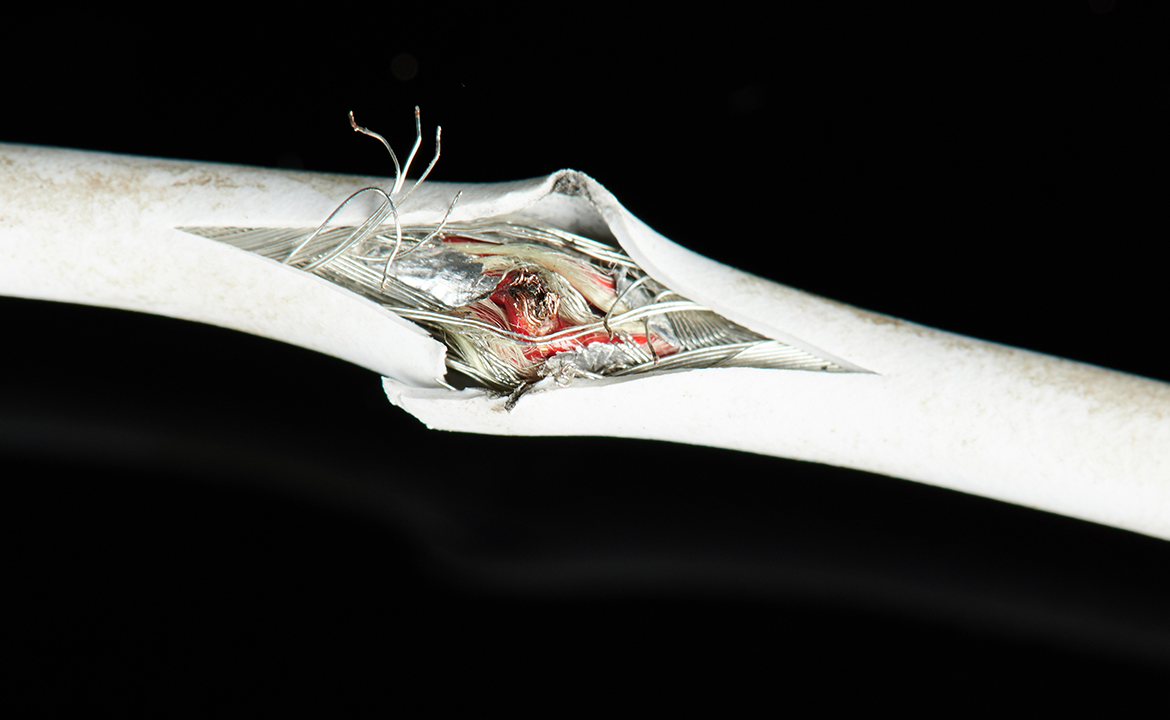

Whether it’s a good idea to purchase an extended warranty or what some dealers call a separate “service contract” depends on different factors.

First and foremost, you will need to know what the factory warranty specifically covers and whether it provides adequate protection for the time you plan on owning the automobile. An extended service contract might be a good idea if you drive a lot or plan on keeping the vehicle for a long time.

In the case of a used car, an extended manufacturer’s warranty can often make a great deal of sense. It is best to get the extended service contract that the manufacturer provides rather than from an independent warranty company. That’s because the factory is not going anywhere, and repairs will be honored at almost any dealership.

With other warranty companies, you never know what might turn into a hassle down the road. The price of an extended service contract from an independent often varies widely and mostly depends on the term, mileage, and carrier.

The factory’s extended service contracts are slightly more expensive but are almost always the best warranty coverage you can purchase.

What Are Special Dealer-Added Options?

Dealer offer of aftermarket accessories

One trendy aftermarket item is undercoating, paint, and fabric protector. These types of products usually do not cost the dealer much and are profit-making items for the dealer. If you decide to purchase an add-on package, make sure you negotiate the best possible price.

In some areas of the country, the dealer or regional distributor will undercoat the new automobiles as soon as they arrive at the dealership or port and add a sticker to the window. The same holds for dealer-installed options like alarms, upgraded stereos and navigation systems, roof racks, running boards, trailer hitches, and lift/lowering kits. These can be later purchased through the dealer or local businesses.

If you are comfortable with what the dealer offers and their asking price, there is no reason not to buy through the dealer. Other dealer-installed or aftermarket items include sun/moon roofs, mudguards, pinstripes, floor mats, tinted windows, custom wheels, and more.

Whether or not you buy any of these items depends on what they are charging and whether or not you want to finance them into your loan. This is an excellent way to get the extras you want without coming up with the cash.

Helpful Consumer Car-Buying Resources

Here you will find a compiled list of helpful car-buying resources that will assist you in finding the most suitable new or pre-owned vehicle for your specific needs at an affordable price.

Being Informed Gives You Leverage

Kelley Blue Book

KellyBlue Book is one of the oldest and most trusted resources for helping consumers determine retail, wholesale, and trade-in values for most used cars and new car pricing tips and tools.

Consumer Reports

Consumer Reports is a subscription-based website. However, this site has precious content, such as new car prices, comparisons, crash ratings, quality ratings, and more.

Cars Direct

CarsDirect is an online resource that is both simple to use and straightforward. It even lets you search by monthly payment. This consumer-friendly website helps you compare different vehicle makes and models and will obtain the vehicle’s invoice and MSRP, including what you can expect to pay for your particular vehicle.

Search results include offerings from both dealers and private owners, with an option to view your selected vehicle’s Carfax report.

Car History Report

The Carfax History Report is available on all used cars and light trucks sold after 1981 or later. They have a proprietary numbering system that can identify a specific vehicle through its official VIN.

The Carfax database of used cars is made up of billions of vehicle records – any one of which can be called up instantly. Some of the information contained in their records include:

- Information on prior accidents and damages, including whether the vehicle’s airbag was deployed in the accident.

- The record will also show a prior accident’s point of impact and severity level.

- Title information includes salvage title designations.CLending Tree – Auto Loans

Lending Tree is an online lender for all types of loans and credit profiles. They are known to specialize in auto loans for people with poor credit scores.

A poor credit auto loan is a regular auto loan with a precise interest adjustment based on your specific credit score.

Free Credit Report

Free Credit Report offers a free credit report which will help you determine the financing options, terms, and interest rates you will likely be offered based on your credit profile.

The more you know before going into a dealer determines what you can expect in the negotiation process.

My Auto Loan

My Auto Loan is known for helping people with less-than-perfect credit for a new or used car. This auto broker and information resource claim its application and loan processes are private, secure, and confidential.

They also represent that there are no fees or obligations to use one of their recommended lenders.

Get Help – Consumer Rights Lawyers

If you are having continued problems with your new or used vehicle and believe you purchased a lemon or if the dealer or manufacturer is not honoring their warranty, we recommend you contact and consult an online Consumer Rights Lawyer about your specific legal issues.