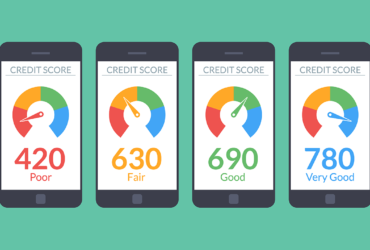

A report that calculates and scores a person’s creditworthiness

Your credit report is a statistical evaluation of your creditworthiness. It examines your credit history based on a number of factors including:

- The amount of debt you have

- Length of credit history

- Identity of creditors

- Amount of credit extended

- Repayment history

- Number of late payments

- Number of missed payments

- Bankruptcy filings

- Public records (judgments, liens, foreclosures)

If you are denied credit, the law requires that you be entitled to a copy of your credit report and the basis for the denial.