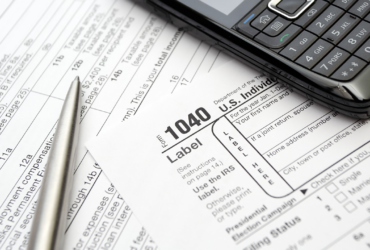

At the time of death an estate tax is imposed on the net value of a person’s taxable estate after any lawful exclusions or credits

The main difference between inheritance and estate taxes is the person who pays the tax. Unlike an inheritance tax, estate taxes are charged against the estate regardless of who inherits the deceased’s assets.

According to the IRS, federal estate taxes are levied on assets of more than $12.06 million for 2022 and $12.92 million for 2023.